when will capital gains tax increase take effect

Here are 10 things to know. Capital Gains Tax Rates 2021 To 2022.

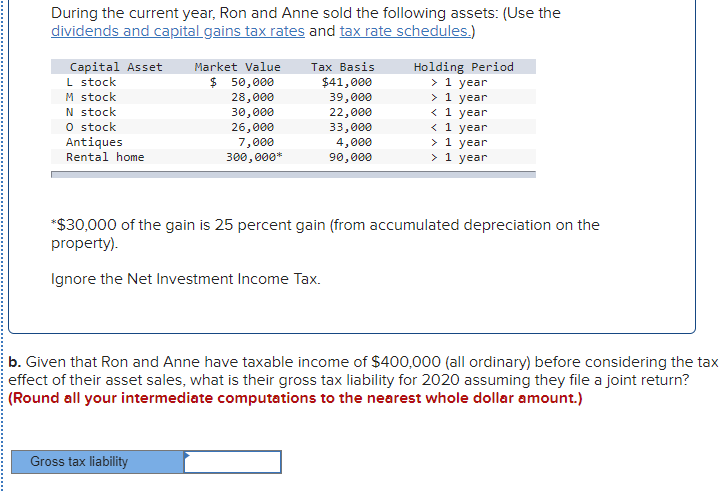

Solved During The Current Year Ron And Anne Sold The Chegg Com

The tax takes effect on Jan.

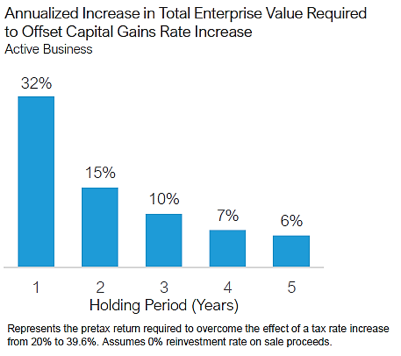

. The federal income tax rate which will apply to your gains from stock sales mutual funds or any of your other capital assets will depend. By Michelle Seiler Tucker July 07 2021 1038 am. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be.

How the increase in capital gains taxes can affect your clients business. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The top tax rate on long-term capital gains -- that is returns on the.

Reduce your taxable income. The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

Hundred dollar bills with the words Tax Hikes 1. President Joe Bidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for high. The capital gains tax on most net gains is no more than 15 for most people.

EDT 5 Min Read. Long-Term Capital Gains Taxes. That rate hike amounts to a staggering 82 increase in the old rate.

If the effective date is retroactive. Specifically the plan calls for higher taxes on capital gains for those earning 1 million or more per year. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate.

The recent change in presidency is set to bring about substantial changes in the way high-net worth individuals are. Its the gain you make thats taxed. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

Originally posted on Accounting Today on July 7th 2021. Make investments in Isas as any gains are tax. If this were to happen it may not only.

Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Only individuals owing capital gains tax are required to file a capital gains tax return along with. In 2021 the estate and gift tax exemption of 117 million 234 million for married couples will still allow your clients to pass on up to that amount before paying any estate tax but any assets rising above that threshold are at risk of double taxation estate tax and capital gains tax without the step-up exemption.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. By Tax Wealth - July 23 2021. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

This means that high-income investors could have a tax rate of up to. According to the UK Government CGT is a tax on the profit when you sell or dispose of something an asset thats increased in value. If enacted as described in the document the rate hike would take effect for gains recognized after the date of announcement This appears to refer to April 28 2021 the date.

1 2022 and the first payments are due on or before April 18 2023. The 238 rate may go to 434 for some. Capital gains taxes on assets held for a year or less correspond to ordinary.

2 days agoA blog on the Cap X site says that whenever politicians are casting around for taxes to increase one hoary old chestnut is the desire to increase CGT to the same rate as income. The recent change in presidency is set to bring about substantial changes in the way high-net worth individuals are. The recent change in.

2023 capital gains tax rates. Capital Gains Tax. Additionally there has been a proposed increase to.

Effect of Capital Gains Tax Increase.

How You Might Prepare For Higher U S Taxes Chase Com

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Biden S Capital Gains Tax Hike What It Means For Your Taxes Cnet

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

How The American Taxpayer Relief Act Will Affect You Myatt Bell

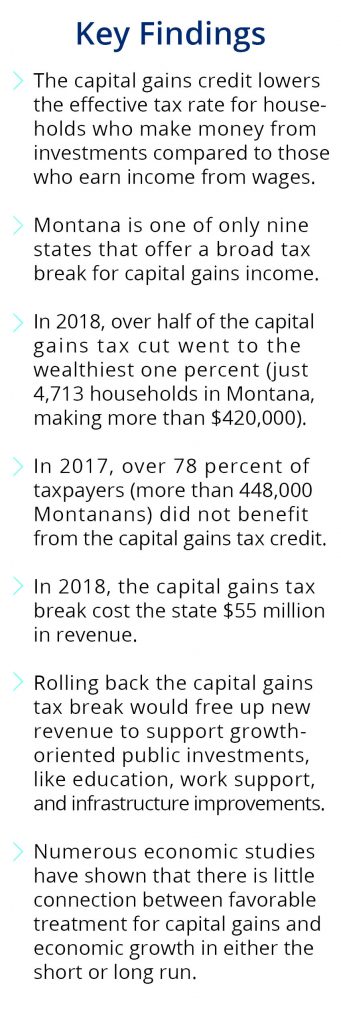

Capital Gains Tax Credit Valuing Wealth Over Work In Montana Montana Budget Policy Center

Obama S Capital Gains Tax Hike Unlikely To Increase Revenues The Heritage Foundation

As U S Capital Gains Tax Hike Looms Wealthy Look For Ways To Soften The Blow Reuters

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Capital Gains Tax In The United States Wikipedia

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

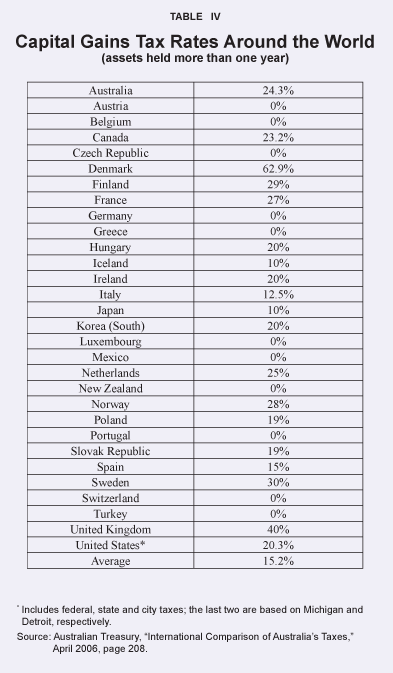

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Obama S Tax Bill Comes Due Job Creators Network

How Could Changing Capital Gains Taxes Raise More Revenue

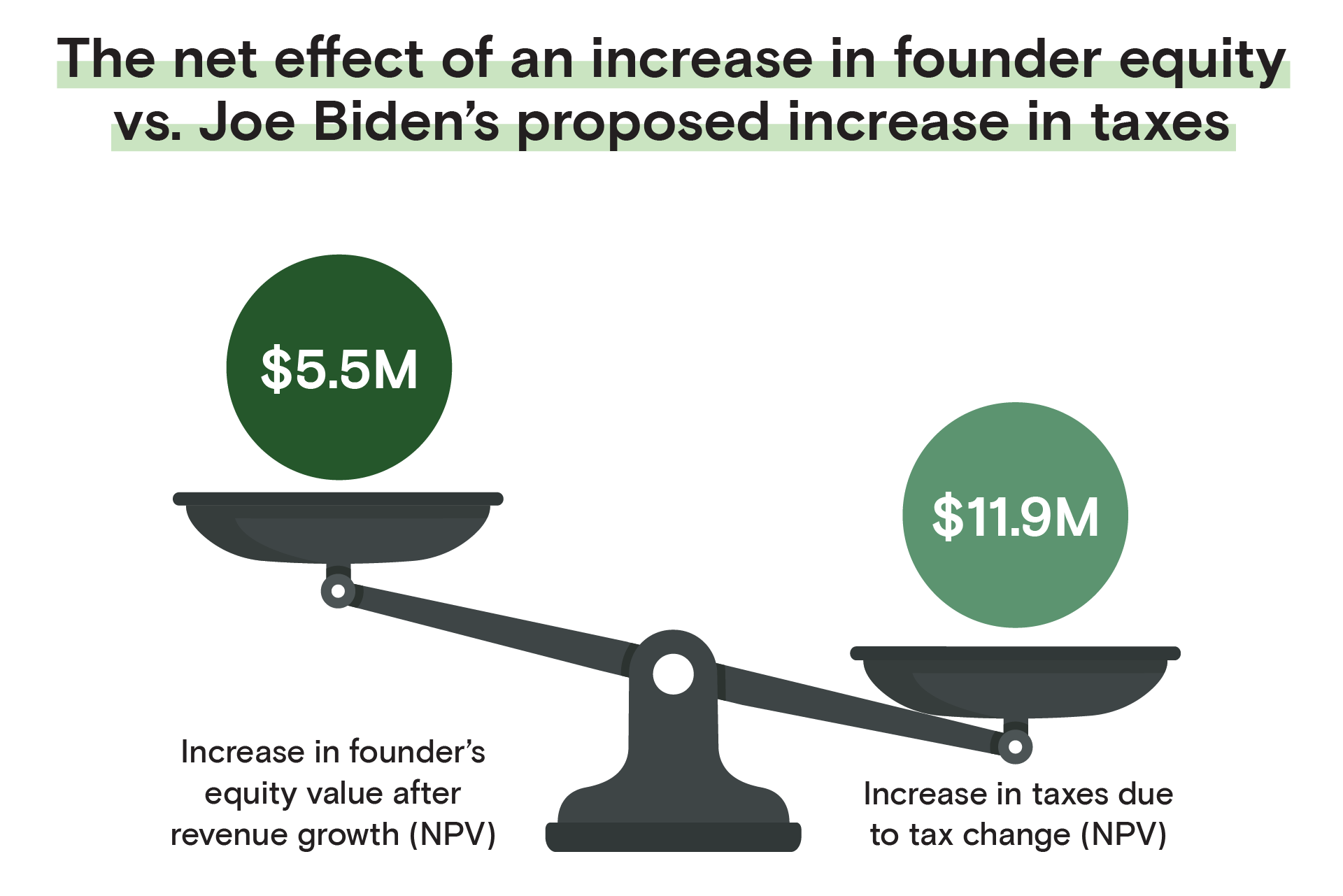

For Founders The Implications Of Joe Biden S Proposed Tax Code